3Q18 Contract Price Hike for Server DRAM Limited Due to Improved Supply, Says TrendForce

The shortfall in the supply of server DRAM may ease in the second half, as evidenced by the increasing average shipment fulfillment rate in the past several quarters, according to DRAMeXchange, a division of TrendForce.

As a result, following the 10% sequential hike in contract prices in the first half, the average shipment fulfillment rate has topped 80% now, thanks to the adjustment of output share of server DRAM by DRAM suppliers, which has helped to ease the tight supply situation, says Mark Liu, the senior analyst of DRAMeXchange.

DRAMeXchange points out that the prices of 32 GB server modules to be shipped to the first-tier firms in Q3 may advance by 1-2% to US$320. Meanwhile, second-tier makers will become benefited thanks to increased shipment fulfillment rates. Consequently, the range of quotes for Q3 contract prices will be limited.

Meanwhile, affected by the increased penetration rates of Intel’s Purley and AMD’s Naples platform, the average density and penetration rate of 32 GB product lines will increase in the second half, sustaining the demands for server DRAM. The stocking-up demands for Intel's new solutions will remain robust, with shipment still mainly for data centers in North America and China. The penetration rate of Intel’s Purley platform is expected to approach 80% in Q4, up from over 50% now, while penetration rate of 32 GB server modules will exceed 70% by the end of the year, according to DRAMeXchange.

In terms of the development of process technology, 20 nm will remain the mainstream process for DRAM this year and stocking-up demands for high-density server modules will continue to the end of the year, thanks to the effect of new platform solutions. Currently, the share of products featuring advanced process remaining low. In addition, die shrink technology will become increasingly complicated after the migration to 17 nm and 18 nm processes. Therefore, except Samsung which has applied 18 nm process in the mass production of server products, other DRAM suppliers will not begin increasing the share of products with advanced process until Q4, due to the consideration of product reliability.

在线留言询价

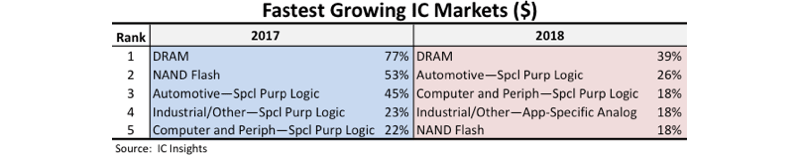

DRAM Prices Forecast to Crash in Q1

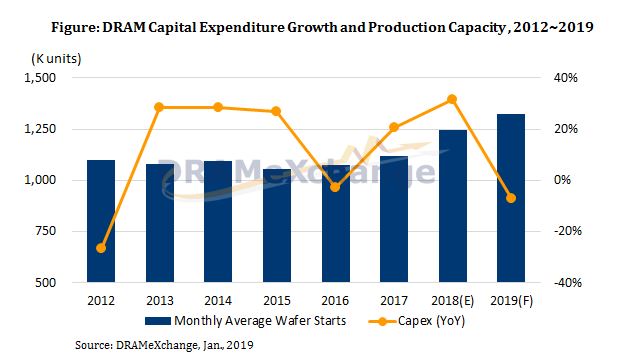

DRAM Market to See Lower Capital Expenditure and Moderated Bit Output in 2019 Due to Weak Demand

DRAM Outlook Dims for 2019

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| MC33074DR2G | onsemi | |

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注