New ICs Put ST in Robocar Race

In the automotive industry’s battle over highly automated vehicle platforms, STMicroelectronics doesn’t get much respect as a head-to-head rival to Nvidia, Intel or Renesas.

But underestimating ST’s role in the global automotive market is a risky proposition.

Although the company has yet to make formal product announcements, ST has a wealth of technologies up its sleeve for the rapidly changing automotive landscape. They start with a family of powerful MCUs — based on ARM Cortex-R52, six cores — designed for the exponentially growing data flows in the automotive world. ST also boasts its own 360-degree ASIC vision processor for L3/L4 autonomous vehicles, currently under development with an unnamed partner, which is not Mobileye. ST will leverage a CMOS 28-nm FD-SOI technology for both new chips.

In addition, ST is devising a new lidar ASIC, for which it is reusing the time of flight (ToF) concept it has already developed, supplied and proven in high-end smartphones.

ST appears to be neither ignoring nor falling behind in the highly autonomous vehicle race. What’s different is that the Franco-Italian chip company is seeking to generate revenue by engaging in a much more diverse set of automotive segments.

Phil Magney, founder and principal at VSI Labs, observed: “When it comes to STMicroelectronics, we don’t see them much in the AV (automated vehicle) stack where we see a lot of the other semiconductor companies. However, ST is well diversified within auto and they have strong market shares across many auto domains from infotainment, ADAS, powertrain, body control, etc.”

Indeed, Marco Monti, president of ST's automotive and discrete group, said last week in an interview with EE Times: “Silicon content in automotive is progressively increasing.” This jump in chip content involves all automotive segments — from normal internal combustion engine cars and telematics to hybrids, EVs and autonomous vehicles. ST’s strength, said Monti, “is in our ability to catch all the growth opportunities coming from transformational trends in all sectors of automotive.”

More data processing needed by ECUs

Last week, ST tipped off the company’s three new automotive chip projects under way, none of which has been formally announced.

One is a new powerful ARM Cortex-R52-based engine control unit (ECU), consisting of six cores running at 400MHz. Designated “Stellar,” ST’s new ECUs will become a full-blown, scalable family of chips, designed to address “specifically the power train and safety roadmaps,” according to Monti. Scheduled for sampling this year, the new ECU will be fabricated by using 28nm FD-SOI process technology.

ST aims to increase its processing power 15 times compared to ST’s Power Architecture-based 32-bit automotive MCU (three cores, running at 200MHz using 40nm process technology).

Asked about the competitive advantage of the new ECU, Monti pointed to multiple factors. First, ST claims it has optimized both its architecture for the internal network connecting the cores, and its peripherals. Further, Monti added that ST is using its “own unique 28nm FD-SOI technology that integrates a new flash cell (phase change memory)” of 16/32 Mbyte.

ST-Mobileye tie extends to 'EyeQ6'

Three-quarters of ST’s automotive revenue today comes from high-volume automotive market sectors. They include such mundane stuff as car audio, ICE power train, passive safety and body.

For example, ST claims it has 33 percent market share in ASIC/ASSP for engine control, 45 percent in car lighting, 40 percent in audio amplifier and 30 percent in RF and vision systems for ADAS.

While the revenue of these products doesn’t derive directly from the highly automated vehicle field, this “solid foundation for automotive technology” in a variety of segments makes ST a strong partner for companies such as Mobileye and Intel, Moti insisted.

Monti noted that neither Mobileye nor Intel has much prior experience in the automotive industry — other than their expertise in algorithms and computing. He said, “We consider ourselves as a genuine partner for Mobileye and now Intel/Mobileye.” He explained that ST, with its own, solid automotive competence, can integrate Intel/Mobileye’s IPs (algorithms), generate the net list, and manage production and testing of their flagship vision processors. ST can ensure that Mobileye/Intel’s EyeQ chips meet all the automotive-grade safety requirements.

Intel/Mobileye’s next-generation vision processor EyeQ5, designed for L4/L5 vehicles, will start sampling this year. Up until EyeQ4, Mobileye has been sourcing it to ST to use ST’s 28nm FD-SOI technology for production.

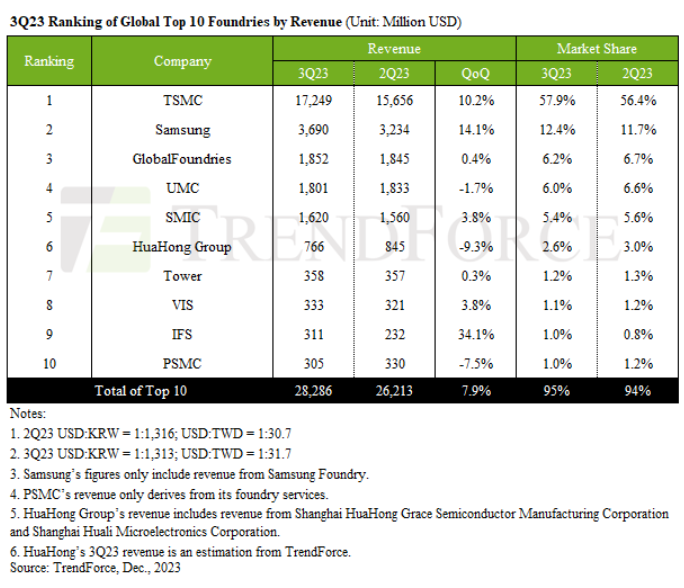

Although Intel/Mobileye is switching process technology for EyeQ5 from FD-SOI to FinFET, the new chip is evidently produced not by Intel but by Taiwan Semiconductor Manufacturing Co. (TSMC).

ST’s Monti said ST works closely with TSMC to use standard lithography technology and characterize the chip. EyeQ5 is being manufactured by using a 7nm FinFET process technology at TSMC, he said. ST’s relationship with Intel/Mobileye appears to extend well beyond EyexQ5 to yet-to-be-announced EyeQ6 autonomous driving processor, designed for Level 5 vehicles, due in 202X.

ST’s own 360-degree vision processor

Aside from ST’s partnership with Mobileye, ST’s Monti acknowledged that his team is also designing a separate 360-degree ASIC vision processor.

Asked about details, Monti told us, “This is the same type of collaboration as with Mobileye, but with another leading automotive technology supplier.”

He declined to name the partner, but explained, “We are integrating their IP for a vision-based processor with deep learning into a CMOS 28nm FD-SOI automotive-grade solution.” The target is Level 3/Level 4 assisted driving applications, he added.

Lidar ASIC is coming

ST is also bullish on its efforts in sensor technology development.

VSI Labs’ Magney noted, “ST is stepping up in sensors technologies such as radar, camera and Lidar but like other areas, ST is typically a component within a module. In auto, ST Micro is a kind of behind the scenes by supplying selective components that are critical for various applications — such as SiC diodes which are necessary for EVs.”

One of the most notable developments currently going on at ST is its foray into lidar chip development. Monti said, “We are developing a chip that goes into a lidar’s receiver.” ST is leveraging a “ToF concept” it has developed and designed into high-end smartphones, Monti said.

“We are designing this as an ASIC function in the automotive market for lidar.” The chip will start sampling in 2019 and ST expects tier ones and system OEMs will use it in the 2020/2021 production models.

Monti is a strong believer in lidar. Acknowledging that some vendors elieve a combination of good vision processors and radar chips could someday render lidars superfluous, he said, “That is not going to happen. For level 5 cars, you do need lidars. It’s a must-have sensor technology for redundancy purposes.”

One of the hurdles for lidars today, however, is cost. “With the silicon technology that reliably works, we are confident that lidars in high volume will achieve the target cost,” said Monti.

ST’s lack of presence in the AV stack, however, begs the question of whether ST ever plans to pursue the AV platform approach. Observing that ST has not jumped into the AV stack but rather maintained a position of supporting componentry, VSI Labs’ Magney said, “Developing an AV stack requires so much collaboration, and the jury is still out on the right mix of processor technology.” He defended ST by noting, “So these bets are costly and less certain compared to the supporting componentry.”

ST and SiC

Agreeing with VSI Labs’ Magney, Zhen Zong, senior analyst for auto semiconductors at IHS Markit, said ST is different due to its “very broad portfolio spanning various applications in automotive.”

Zong pointed out that ST’s analog ICs, MCUs, Logic ICs, and discrete components are used in many different car models around the world. He said, “Analog ICs — used for passive safety systems and ABS braking systems -- place ST as the leader in the automotive analog IC market segment, according to our analysis.”

ST is also generating a lot of interest among financial analysts, because it is building a complete product line covering low voltage MOSFETs to high voltage IGBTs, as well as other power devices. Zong said, “This means ST is potentially well aligned with the coming requirement for power electronics in emerging HEV and EV markets electric assist car manufacturers, with building blocks needed for an overall design solution.”

ST’s Monti acknowledged that Silicon Carbide (SiC) adoption is moving faster than expected. In the second half of 2017 alone, ST shipped more than 2 million SiC modules. ST expects annual shipments to expand tenfold in 2018.

Among various innovations ST has developed in the SiC market, one product Monti’s team is very proud of and is dying to talk about — and yet isn’t allowed to — is the development of a dedicated SiC module that can be dropped into a customer’s power modules. “The solution is a classic case of mechatronics” that works very well, he said.

In SiCs, however, ST isn’t the only game in town. IHS Markit’s Zong noted, “Both ST and Infineon have great experience in power electronic IC development and are expending a lot of effort into the SiC business. In terms of silicon carbide MOSFETs, STMicroelectronics is deploying a device based on a planar structure, he explained. Infineon on the other hand is using a trench gate structure, “which is a newer generation technology with better performance, but of course with lower maturity.”

ST and Infineon are in the SiC business because both see the growing need “to support high voltage EV applications,” said Magney. “The market is young for high voltage automotive but the outlook is pretty strong for high voltage applications up to 800 volts.”

IHS Markit’s Zong explained that SiC device development has been “beleaguered by material quality over the years.” He said, “One of the leaders in the development of power devices (MOSFETS, diodes, etc.) was Wolfspeed, a Cree company. Infineon would have gained huge advantage if its 2017 acquisition attempt of Wolfspeed had been approved. The deal was subsequently denied by the US government for strategic reasons.”

From a market perspective, Zong said, “STMicroelectronics has a high visibility order with Tesla, although Infineon has an overall strong position in the Chinese market.” He added, however, that it’s too early to say which company will gain the inside track.

在线留言询价

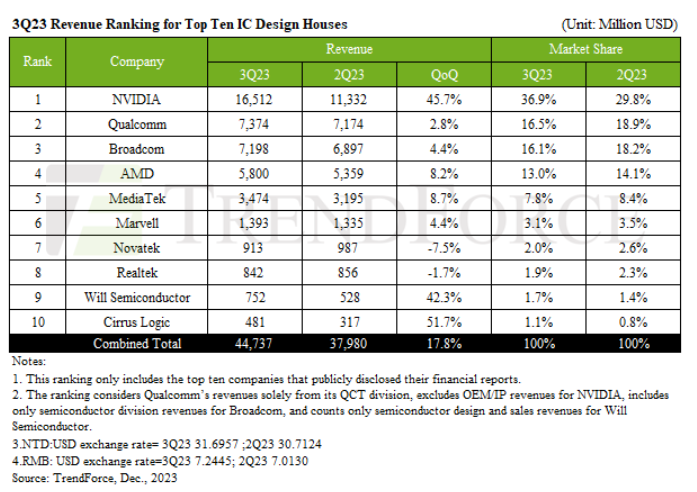

Unveiling the Intricacies of IC Design

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| MC33074DR2G | onsemi | |

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BP3621 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注