Advanced Technology Key to Strong Foundry Revenue per Wafer

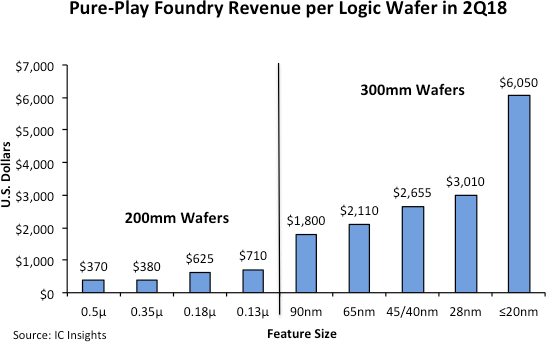

Analysis shows more than a 16x difference between the average revenue generated by 0.5µ 200mm wafers ($370) and ≤20nm 300mm wafers ($6,050).

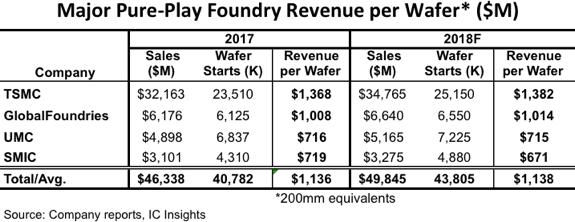

The average revenue generated from processed wafers among the four biggest pure-play foundries (TSMC, GlobalFoundries, UMC, and SMIC) is expected to be $1,138 in 2018, when expressed in 200mm-equivalent wafers, which is essentially flat from $1,136 in 2017, according to a new analysis by IC Insights (Figure 1). The average revenue per wafer among the Big 4 foundries peaked in 2014 at $1,149 and then slowly declined through last year, based on IC Insights’ extensive part-two analysis of the integrated circuit foundry business in the September Updateto The 2018 McClean Report.

Figure 1

TSMC’s average revenue per wafer in 2018 is forecast to be $1,382, which is 36% higher than GlobalFoundries’ $1,014. UMC’s average revenue per wafer in 2018 is expected to be only $715, about half of the projected amount at TSMC this year. Furthermore, TSMC is the only foundry among the Big 4 that is expected to generate higher revenue per wafer (9% more) in 2018 than in 2013. In contrast, GlobalFoundries, UMC, and SMIC’s 2018 revenue per wafer averages are forecast to decline by 1%, 10%, and 16%, respectively, compared to 2013.

Although the average revenue per wafer of the Big 4 foundries is forecast to be $1,138 this year, the amount generated is highly dependent upon the minimum feature size of the IC processing technology. Figure 2 shows the typical 2Q18 revenue per wafer for some of the major technology nodes and wafer sizes produced by pure-play foundries. In 2Q18, there was more than a 16x difference between the 0.5µ 200mm revenue per wafer ($370) and the ≤20nm 300mm revenue per wafer ($6,050). Even when using revenue per square inch, the difference is dramatic ($7.41 for the 0.5µ technology versus $53.86 for the ≤20nm technology). Since TSMC gets such a large percentage of its sales from ≤45nm production, its revenue per wafer is expected to increase by a compound annual growth rate (CAGR) of 2% from 2013 through 2018 as compared to a -2% CAGR for the total revenue per wafer average of GlobalFoundries, UMC, and SMIC during this same timeperiod.

Figure 2

There will probably be only three foundries able to offer high-volume leading-edge production over the next five years (i.e., TSMC, Samsung, and Intel). IC Insights believes these companies are likely to be fierce competitors among themselves—especially TSMC and Samsung—and as a result, pricing will likely be under pressure through 2022.

在线留言询价

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|

| 型号 | 品牌 | 抢购 |

|---|

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注