十年间,ST在中国MCU市场从崛起到走向辉煌

十年,对于半导体行业来说,是段相对漫长的时光。十年前,ST在欧洲和美国的份额还是很可观的,但在中国的份额却非常小,ST MCU产品只是并不太知名的产品线。十年后的今天,通过对产品精雕细琢并不断创新,通过及时调整产品推广策略并强有力地执行,通过日积月累的不懈努力和坚持,意法半导体在中国的业务取得了惊人的增长!

近日,STM32十周年庆典在京举行,意法半导体亚太区MMS(微控制器、存储器和安全微控制器)及物联网副总裁Arnaud Julienne,意法半导体微控制器事业部市场总监Daniel Colonna,以及中国区微控制器事业部市场及应用总监曹锦东,携手媒体朋友,共同庆祝这一历史性的时刻。

十年,STM32奠定了ST在中国的领先地位

2007年6月11日,意法半导体在北京发布全球首款STM32产品STM32 F1。2007到2012年,在这5年里,STM32的全球出货量达到了1亿片;到了2013年,STM32的全球出货量达到了10亿片;2013~2016短短三年又增加了10亿片。第一个10亿花了6年,第二个10亿只花了3年,而ST的目标是在2017年年底,达到每秒钟32颗STM32的出货量。从6年到3年,再到目标是一年出货10亿颗,这就像个加速器,不断在加速产品的出货量。

十年的时间,ST已经成为中国市场上广为人知、广获好评的MCU品牌,实现了快速而稳健的增长,并建立起强大的STM32生态系统。根据isuppli 2016下半年市场报告, ST已跃升为第二大通用微控制器厂商。从市场份额来讲,2007年到2016年,从2%增长到14%。Cortex产品的市场份额是16.4%,从ARM Cortex市场角度来讲,这个市场的增长也是非常惊人的。

从崛起到走向辉煌,秘诀是什么?

十年的光景,ST何以在中国市场创造了这样的神话?意法半导体亚太区MMS(微控制器、存储器和安全微控制器)及物联网副总裁Arnaud Julienne给出了答案:从发布STM32 F1那一天起,ST改变了在中国市场的产品推广策略,在不断开发更加丰富的产品线的同时,努力通过更加丰富的市场活动,让在校的学生以及工程师能够第一时间了解到STM32产品线及相关技术。

1. 丰富和完善产品线

2007年首发的STM32F1基于Cortex-M3内核,采用180nm工艺,拥有128KB Flash和20KB RAM,72MHz主频,即便到了今天,依然是很多工程师的首选。

经过十年的积累和创新,STM32如今已拥有10大产品系列,700余款产品,涵盖超低功耗到高性能,其强大的产品阵容覆盖各种应用,满足不同需求。其中,STM32 H7是业界首个Core-Mark测试达到2020分的400 MHz Cortex-M微控制器。

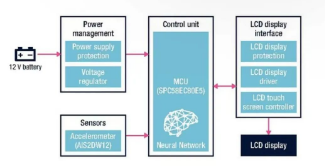

亚马逊为了能让用户提升线上购物体验,每个产品线都配备了一颗按钮,按下对应的按钮以后货物就可以自动运送到家。在其最新的产品里就应用了多个高性能产品STM32 F4和低功耗产品STM32 L0。而2015年ST发布的基于Cortex-M4内核的STM32L4,则兼具低功耗和高性能,完全能够满足当今可穿戴设备和诸多IoT应用的双重需求。

2.孕育和培养大众市场

自从STM32发布以来,ST将更多的精力投放在中小客户和工程师的培养上,通过社区、线上论坛、线下研讨会和峰会、技术培训,以及大学培养计划等多种形式的市场活动,让更多的人了解STM32 MCU产品线的特点和市场策略,进而把STM32作为首选的MCU。日积月累,这些活动也成就了STM32在业界的影响力和知名度。

目前,ST 的业务仅有30%来自大客户,其余70%都是来自中小客户。如今国内非常火热的共享单车,其主流客户采用的正是STM32产品线,它十分适合、贴近客户的需求。这种由于需求吻合、自然形成的客户,常常会使ST对STM32产品线的应用领域有了新的认知。

事实上,ST全球也采用同样的策略,他们会和主流的大客户进行合作,同时也会支持中小客户的设计。往往新的、特别的创意都来自于中小客户,因为中小客户没有太多的限制,设计师会有更加令人称赞的设计,ST希望能够通过自己的渠道、产品的知名度以及媒体的宣传,更好地支持中小客户的产品设计。

STM32的未来更加美好

从过去到今天,STM32 MCU始终是很好的驱动力,驱动着整个市场的变化和市场比例。展望未来,整个MCU市场仍然是在不断成长的,而更大的成长依旧来自于32位MCU。从应用来讲,IoT市场对MCU,尤其是32位MCU的需求、驱动远远超过市场的平均速度。

在北京STM32十周年庆典上,被誉为STM32教父的、意法半导体微控制器事业部市场总监Daniel Colonna先生对STM32产品线的自豪之情溢于言表,他在回顾了过往取得的可喜成绩之后,分享了对于STM32的美好愿景。

意法半导体微控制器事业部市场总监Daniel Colonna

第一,STM32依然保持嵌入式应用,包括IoT、智能工业、智能家居、应用里的核心,ST要做的是发挥它的智慧,通过软件实现更加智能的世界。我们希望STM32在市场上是创新和技术上的领先者、先行者。

第二,我们希望STM32能成为包括大客户和中小客户在内的所有客户,启动他们新项目或是实现新创意时的首选。

那么,如何才能成为大众市场中重要客户的第一选择,实现如此美好的愿景呢?Daniel Colonna先生表示:我们会尽力打造更加优异的产品,为用户提供更加全面的服务,包括MCU和整个生态系统;同时,我们希望STM32作为驱动IoT物联网发展的主要驱动力,能够联合更多的合作伙伴,给用户提供更多IoT方面的参考设计,更有力地激发其内在的无限创造力。

ST如何布局整个垂直应用领域?

未来,ST在垂直应用领域的布局自然是大家关注的热点。对此,Daniel Colonna 先生也做了深入解读。

1. 在IoT市场里,无论是有线的还是无线的,ST都将更加注重低功耗的无线产品线,以及更加高性能的产品线。

2. 在GUI图像显示方面,ST有理想的产品和解决方案,通过三家GUI协议栈合作伙伴,可以提供很好的从低端到高端的用户体验。

3. 安全性是个永恒的话题,ST内部会有更多的安全性设计,以保证用户的设计更加安全。工艺方面,我们会更加注重安全,让系统能够可靠地运行。未来STM32会嵌入更多的安全机制,以提升STM32的安全性。另外,ST作为全球为数不多的拥有全套智能卡方案的供应商,可以给用户提供最基本到最高级安全的所有方面。

4. 在产品设计上,我们会投入更多高性能产品来应对工业控制的需求。作为高性能产品线,STM32 H7这个产品线更多的驱动来自于工业客户对高性能的需求,其中包括相当多中国客户在内。马达控制也是我们从现在到未来重点投资研发的一个应用方向,因为不仅仅在工业控制、消费电子领域,航母、净化器、室内空调、风机等应用都会用到最新的马达控制技术。我们的投入将会给用户带来效率更高的控制技术,为其注入更多高性能方面的优势。

5.作为非常强大的传感器供应商,ST会在和传感器相关的应用领域投入更多,在主要垂直应用方面,涵盖移动传感器、音频传感器和其他IoT相关的传感器技术,ST都会有所投入。

6. IoT是个非常广泛的应用领域,可以驱动传统的应用和行业不断升级。对于无线,STM32有自己的策略,其中很多部分是ST自己设计的,还有一部分是与合作伙伴相关的。在NB-IOT、LoRa、SigFoX方面,我们既有自己的产品,也与优秀的合作伙伴进行技术合作;在Wi-Fi、Bluetooth方面,我们也有自己的产品,今年计划发布第一个蓝牙产品。

结语

2017年,ST的终极目标是,到今年年底,STM32的出货量达到每秒32颗!市场的需求在日益增加,凭借ST强大的综合实力,以及对市场策略的执行力度,我们有理由相信,这个目标不难实现。出货量对ST来讲,更大的挑战在于产能的准备,对此ST也会有很多规划,最大化地满足市场的需求。笔者从业11年,有幸见证了ST在中国MCU市场的崛起并迅速走向辉煌,如今,ST蓄势待发,准备迎接下一个辉煌的十年!

在线留言询价

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| MC33074DR2G | onsemi | |

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| STM32F429IGT6 | STMicroelectronics | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BU33JA2MNVX-CTL | ROHM Semiconductor |

AMEYA360公众号二维码

识别二维码,即可关注