ST Offers eSIMs at Wafer Level

STMicroelectronics has become the first chip maker to be accredited by the GSMA for loading embedded SIM (eSIM) chips with connection credentials such as certificates and operator profiles before shipping.

The eSIMs, customized with connection credentials, enable smaller form factors, greater security, and increased flexibility. Chip-scale, permanently embedded, and electronically reprogrammable, eSIMs save space inside smartphones for extra features or battery capacity, while enabling different types of connected devices in tiny form factors for an expanding range of markets and applications, such as smart watches and internet-of-things (IoT) devices including smart meters, remote sensors, or gateways.

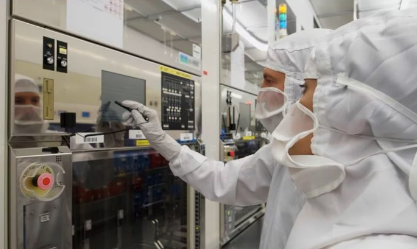

The GSMA, an association representing nearly 800 operators and more than 300 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, has a secure accreditation scheme for UICC (universal integrated circuit card) production (GSMA SAS-UP). The accreditation categories range from any form factor UICC, to embedded form factor and wafer level chip scale packaging. It lists STMicro in Caserta, Italy, being accredited for embedded form factor eSIMs, and STMicro in Rousset, France being accredited for wafer level.

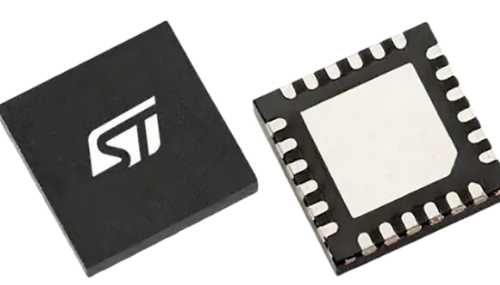

ST says it can now deliver personalized eSIMs, built around the ST33 secure microcontroller, directly to customers’ production facilities, ready to use with no further programming required. Equipment OEMs, mobile network operators, and SIM operating-system (OS) vendors can therefore streamline the eSIM supply chain to save handling overheads and reduce time to market.

“The SAS-UP accreditation of ST’s Rousset (France) production site for the personalization of WLCSP SIMs and eSIMs is a significant move in driving widespread adoption of trusted eSIM devices by enabling consumer and IoT device manufacturers to implement eSIM in very small form factors,” says Jean-Christophe Tisseuil, GSMA’s head of SIM and eSIM. “SAS-UP is a first and essential step towards a secure and trusted eSIM market deployment.”

“The GSMA’s certification scheme governing production and personalization is critical for its success,” said Marie-France Florentin, group vice president, general manager, secure microcontroller division, STMicroelectronics. “Now that ST is accredited to produce and personalize eSIMs before shipping, our customers can benefit from greater efficiency and security throughout the entire supply chain, with all the safeguards and assurances provided by the GSMA’s ecosystem.”

eSIM market

The overall eSIM market is estimated to grow from USD 253.8 million in 2018 to USD 978.3 million by 2023, at a CAGR of 31.0% between 2018 and 2023, according to ResearchAndMarkets. The report says the global eSIM market is in its nascent phase, but with more emphasis likely on remote SIM provisioning for M2M, favorable government regulations boosting M2M communication, and high adoption of IoT technology, this will drive the demand for eSIM solutions.

The M2M market is the current lead application for eSIMs, with rising adoption of IoT across verticals such as automotive, consumer electronics, energy & utilities, manufacturing, retail, and transportation & logistics primarily driving eSIM adoption.

Europe is estimated to hold the largest share of the eSIM market in 2018, followed by North America and Asia Pacific. However, by 2023, North America is likely to hold the largest market share globally. The increasing focus on the linking and digitization of future products and services is boosting the growth of the semiconductor industry for this market. eSIM cards allow remote provisioning of SIM profiles and enable interoperability between connectivity platforms and multiple SIM operator profiles.

The report says major players operating in the eSIM market include Deutsche Telekom AG (Germany), Gemalto NV (Netherlands), Giesecke & Devrient GmbH (Germany), Infineon Technologies AG (Germany), NTT DOCOMO, INC. (Japan), NXP Semiconductors N.V. (Netherlands), Sierra Wireless, Inc. (Canada), Singapore Telecommunications Limited (Singapore), STMicroelectronics (Switzerland), and Telefonica, S.A. (Spain).

在线留言询价

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| MC33074DR2G | onsemi |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| ESR03EZPJ151 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注